Land Title Guarantee Co. releases their market analysis for September:

September 2016 Market Analysis

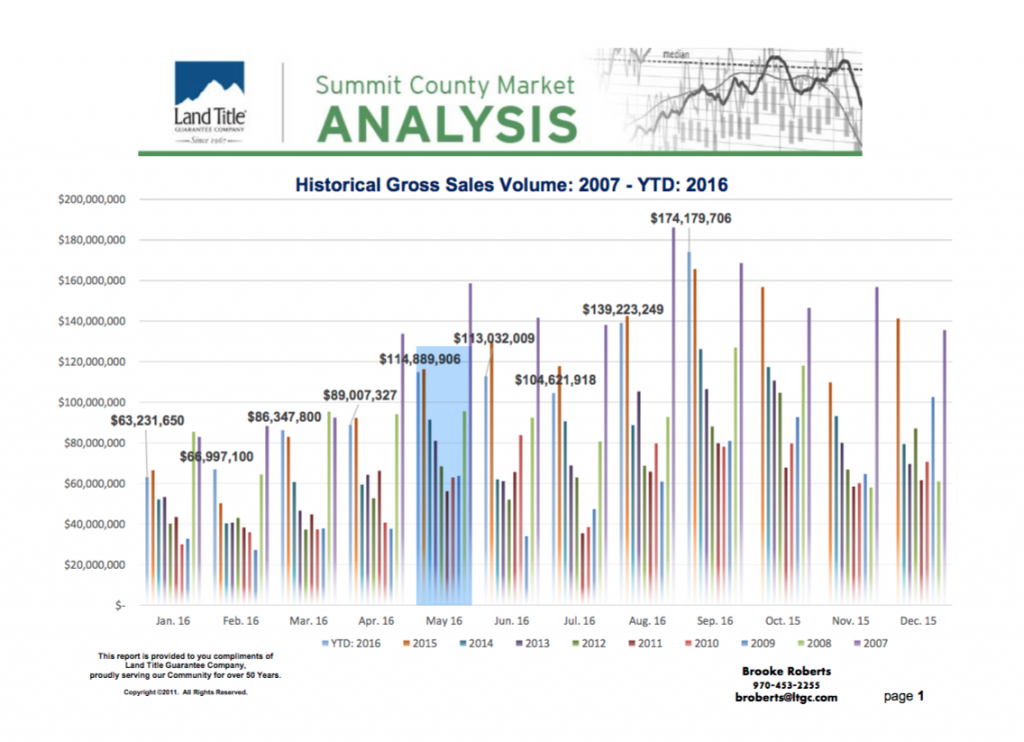

- Market Analysis by Area for September 2016: There were 297 transactions and $174,179,706 in monetary volume. Some trends for all 18 reported areas: $596,761- Average transaction price, $612,119- Average Residential price and $385- PPSF, all up from July and August 2016.

- Year to Date Market Analysis (9 months): Monetary volume was $951,530,665 with 1752 transactions. Average transaction price-$552,761, Average residential price-$569,158 and PPSF-$368.

- Market Snapshot for Years 2016 vs 2015: Average Indicators for $: Single Family +8%, Multi- Family 0% and Vacant Land -10%. Median Indicators for $: Single Family +8%, Multi- Family 3% and Vacant Land -4%.

- Market Analysis % Change YTD 2016 Data ( 9 months): Monetary volume ($174,179,706) in September was up 5% compared to September 2015. Number of transactions (297) was fairly flat at -1% in September compared to September 2015. YTD 2016, monetary volume is pacing flat at -1% compared to YTD 2015 and transactions continue that same trend at -1% compared to YTD 2016. There continues to be a shortage of inventory in Summit County.

- Residential Market Sales by Price Point: Residential volume in September had 243 transactions with $148,744,985 gross volume. There were 29 properties that sold for $1M and above in September. The most active price points were up from the past few months. They were between the $400K-$500K (49) range. There were 87 Single Family, 156 Multi-Family and 16 Vacant Land transactions in September.

- Comparative Historical Cost Analysis ( 9 months): There were 1463 residential transactions and $832,677,478 volume with 150 properties selling for a $1M and over-compared to 2015, there were 1438 transactions and $784,072,868 gross volume, 140 properties at $1M and over and in 2014, there were 1189 transactions with $598,246,081 gross volume, 91 properties at $1M and over.

- Average Price History by Type (9 months): Average price for residential Single Family: $922,641, Multi- Family: $400,798 and Vacant Land: $336,198.

- Top Lender Graph: There were 648 loans in September, 70% of the loans were related to sales, there were 177 REFI’s and 264 loans were timeshare related. 30% of the real estate closings were cash transactions.

- Market Highlights: Please see page 10 of the Market Analysis- You can note the higher priced sale in September in the Lewis Ranch area at Copper and a Waterhouse Condo for highest PPSF. There were no bank sales in September.

- Foreclosures: There was only 1 foreclosure Fee Simple property in September.

- Purchaser Profile Abstract: Upper end purchasers totaled 31 in September. Our buyers for real estate transactions were the Front Range demographic at 38% of our market, 26% are “local” and 36% are out of state buyers with 0% International. There is a new page 15 with the Purchaser Detailed Profile for specifics on our Out of State buyers.

- Land Title New Development Summary: This (page 16) shows all the new construction each month with 17 in September.

Land Title Guarantee Company September 2016 Market Analysis