Here is where you can find all the latest info on the Summit County, CO market from Anne Skinner with The Skinner Team.

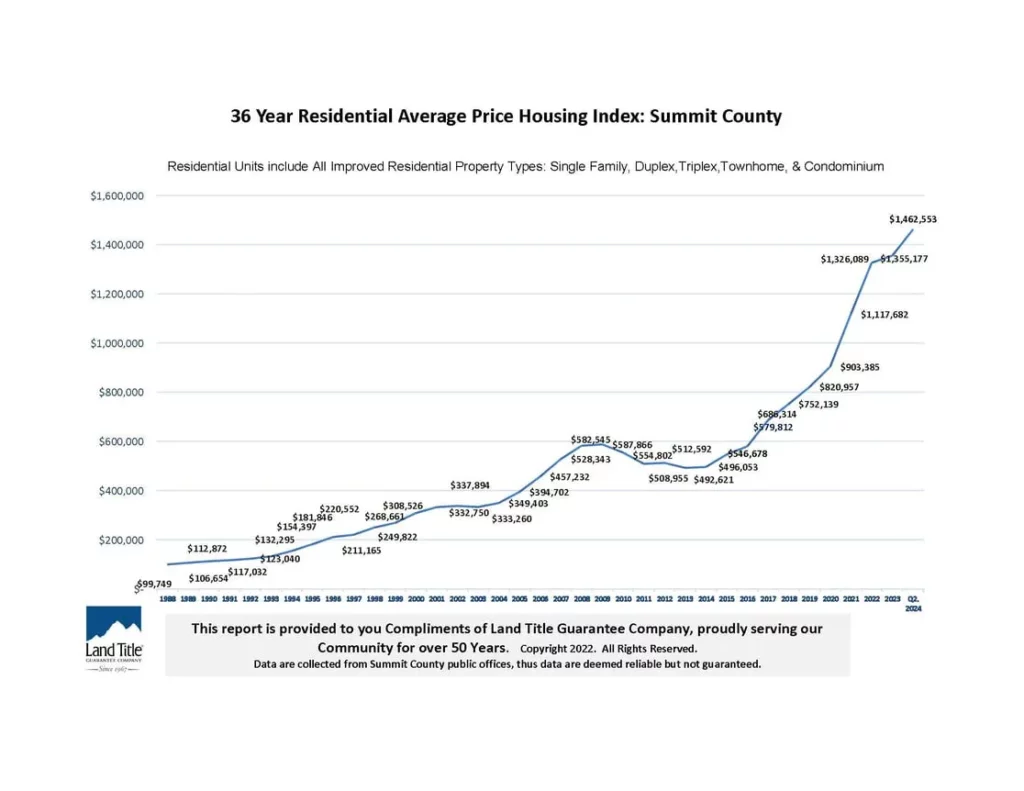

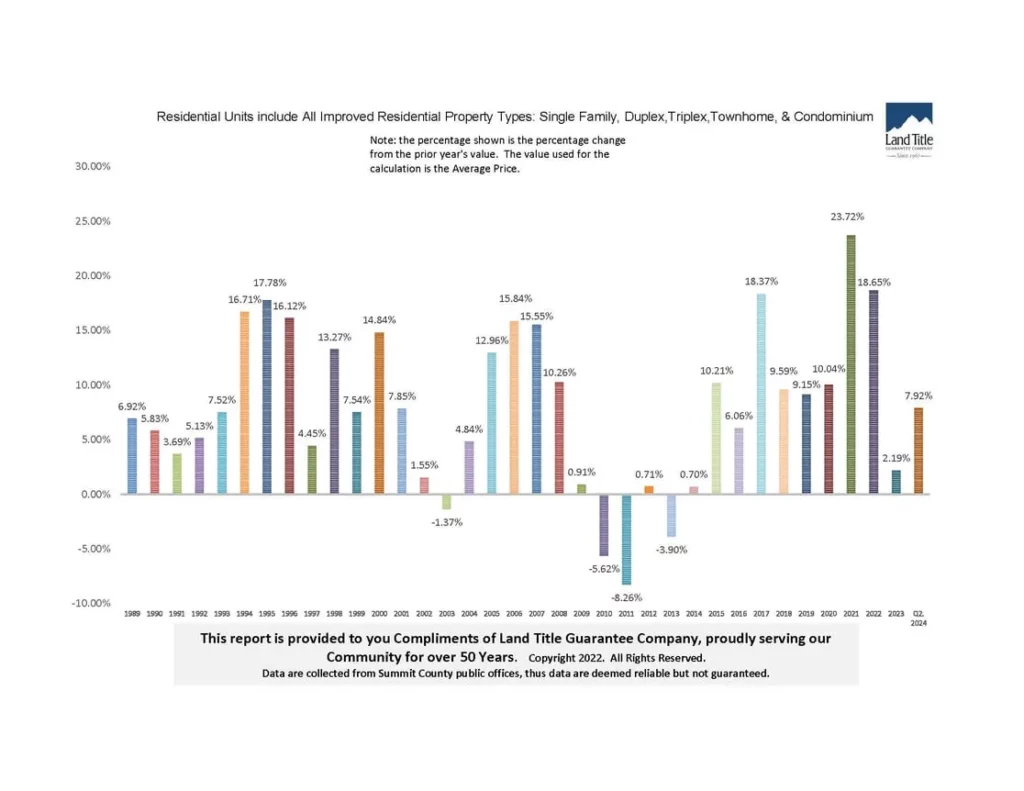

Average Price Indicators:

Median Price Indicators:

YTD 2025:

YTD 2024:

YTD 2023:

Additional Notes:

By clicking “Submit” you agree to receive marketing calls, text messages and/or emails from The Skinner Team regarding the potential purchase, sale or lease of real estate at the phone number and/or email provided, including by using automated technology, and understand that this consent is only for brokers or staff associated with The Skinner Team and no other companies.

Disclaimer: All information contained in this web site is deemed reliable but not guaranteed. All properties are subject to prior sale, change or withdrawal notice. COMtnRealty.com believes all information to be correct but assumes no legal responsibility for accuracy.