Thinking about your rental properties in Summit County or anywhere in Colorado’s high‑country? Just like planning the perfect weekend escape, lining up the right legal structure can make your experience smoother, safer, and more rewarding. Whether you’re managing a few long‑term rentals, overseeing short‑term vacation homes, or considering your first rental property, here’s your roadmap to minimizing risk and maximizing peace of mind.

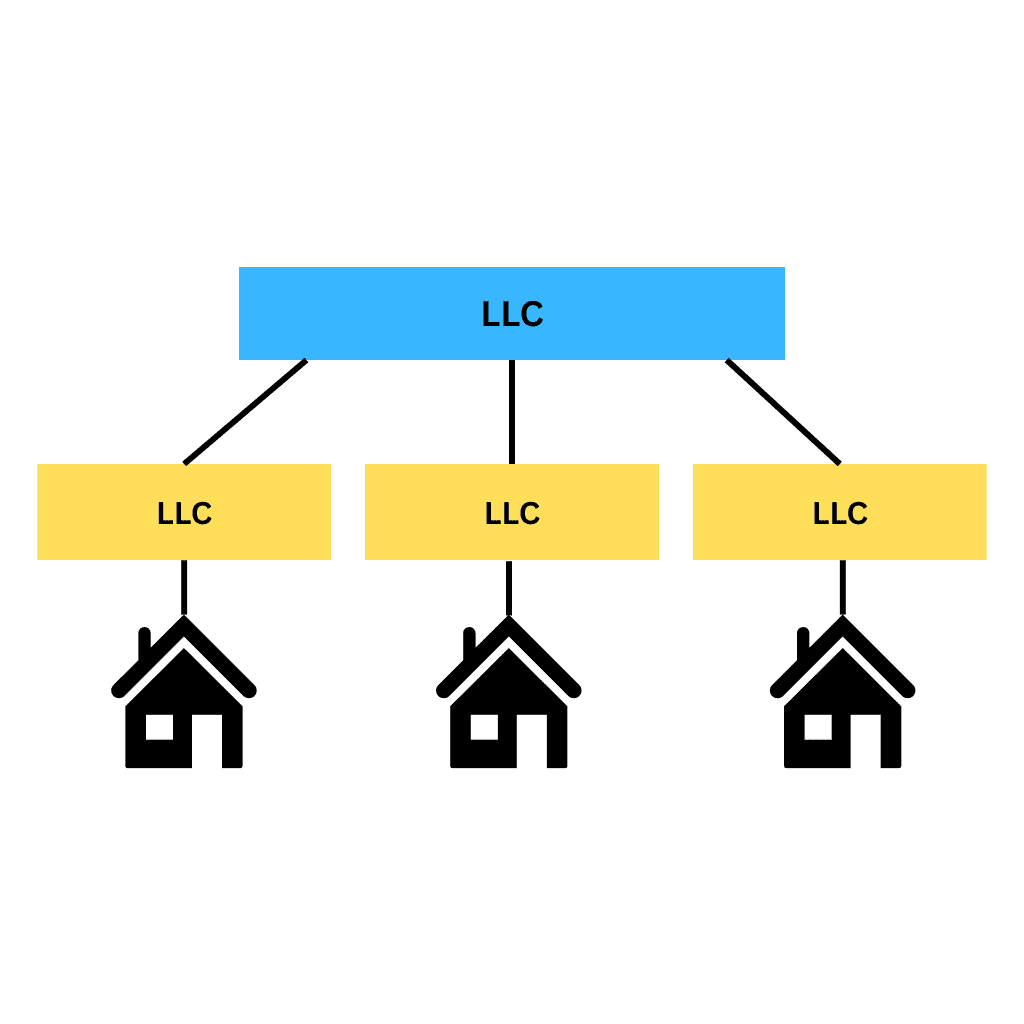

Many mountain property owners use LLCs to shield personal assets from rental-related lawsuits. LLCs offer flexible tax options and a professional structure, with strong liability protection as their main advantage. There are pros and cons to structuring your LLC with a single member or multiple owners so consult with your attorney and tax professional to decide what structure is best for you.

If privacy matters, anonymous LLCs in states like Delaware or Wyoming are an option. You can even hold multiple LLCs within a parent LLC created in Delaware or Wyoming. Lawsuits generally stay within the LLC if you keep personal and business affairs separate, but sometimes anonymity can be valuable. Skipping formalities or mixing funds is risky and can void your protections, so strict separation and good recordkeeping are essential.

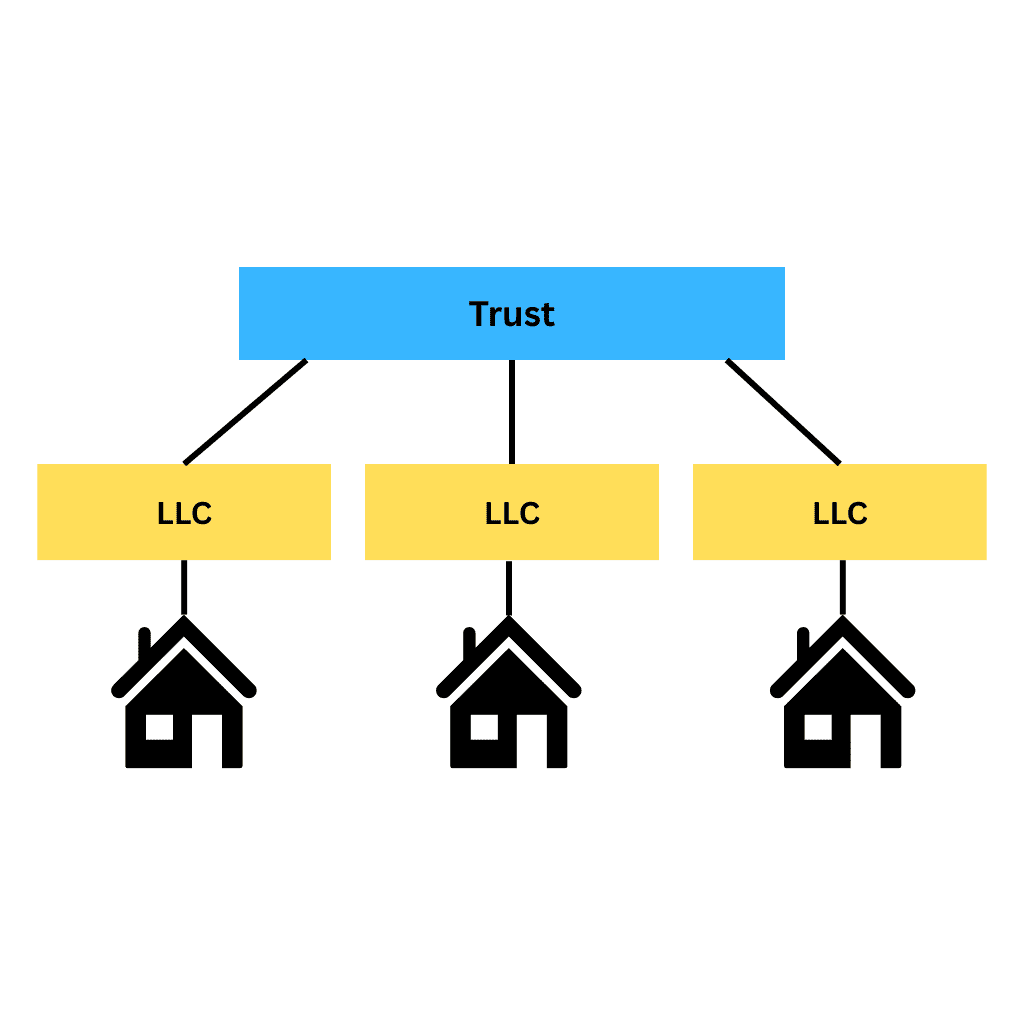

Trusts are valuable estate planning tools that offer privacy, continuity, and smoother property transfers between generations. Revocable trusts help avoid probate and protect your heirs, while irrevocable trusts provide stronger asset protection at the cost of less flexibility. However, trusts can be more complex to set up and manage than LLCs and generally offer weaker liability protection.

A common strategy to get the best of both worlds is to hold your LLC inside a trust. This way, the LLC handles day-to-day management and liability protection, while the trust ensures privacy, probate avoidance, and seamless generational transfer. For example, your Breckenridge short-term rental could be owned by an LLC, which is in turn owned by your revocable living trust, so if anything happens, your heirs take over without court delays or hassles.

When you transfer a property you already own into an LLC or trust, it’s important to understand how this affects your short-term rental (STR) permits and related requirements. Before making any changes, check with your local short-term rental authority to determine whether your permit can be transferred or modified without being revoked. While most local jurisdictions, including Summit County and Breckenridge, allow ownership changes without automatically losing your STR permit, rules can change, so always verify with your local rental authority. If you’re on a waitlist for a permit, changing ownership may mean losing your place and starting over at the back of the line.

Mortgage lenders are another critical piece of the puzzle. Even transfers that are purely on paper can trigger “due on sale” clauses, potentially requiring full repayment of your loan. It’s essential to consult your lender beforehand to navigate ownership changes without triggering these clauses.

Don’t forget insurance. Changing the ownership structure means updating your insurance company to ensure your coverage remains valid and appropriate.

Finally, while STRs have specific lodging, sales, and occupancy tax rules that differ from long-term rentals, the entity you choose—whether an LLC or trust—can impact tax filings and licensing compliance. Keep these factors in mind when planning your ownership transfer.

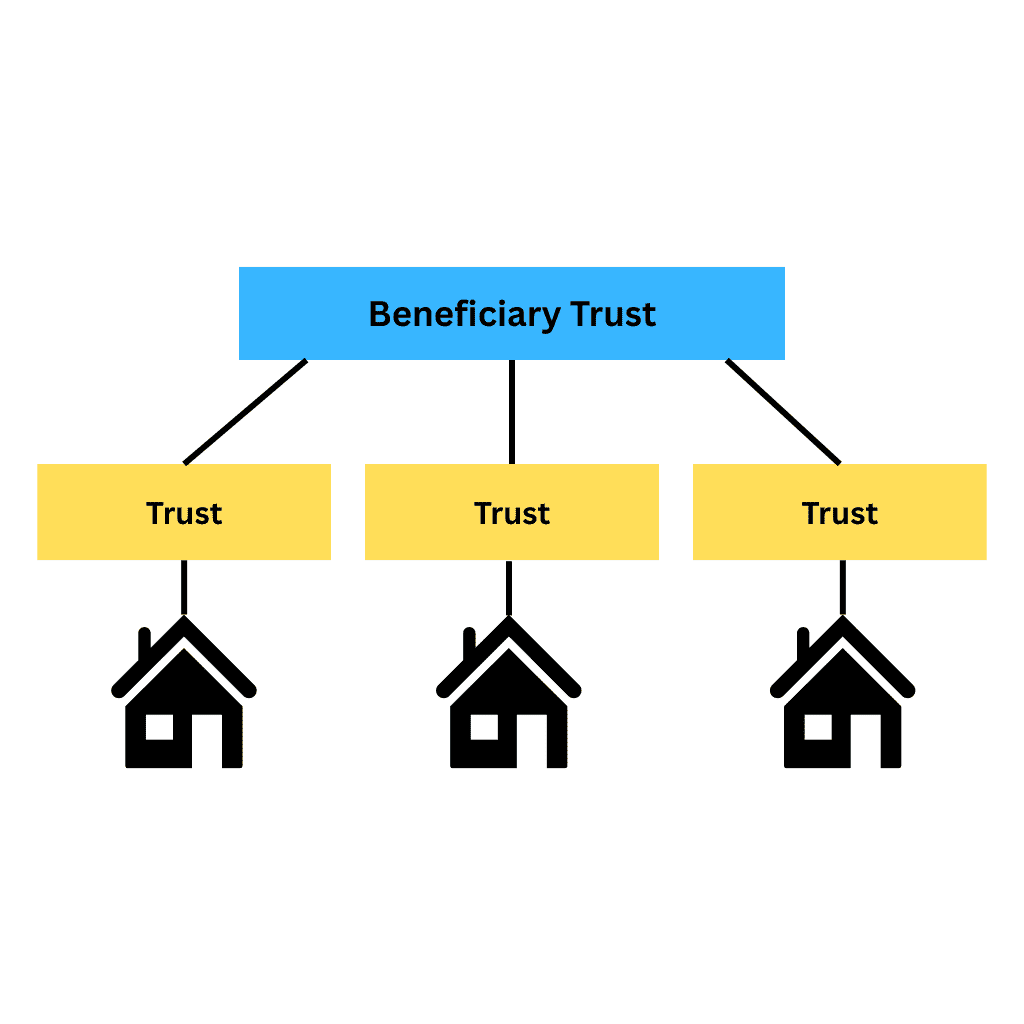

When it comes time to sell, your exit strategy depends on how the property is held. If it’s in an LLC, you may be able to transfer membership interests instead of the property itself, though this involves valuation and paperwork. Properties held in trusts often pass more seamlessly to heirs, frequently avoiding probate. Combining an LLC with a trust can streamline generational transfers while preserving both liability protection and privacy.

If you’re planning a 1031 Exchange to defer capital gains taxes, remember that the replacement property must be purchased under the same name or entity that held the original property. This rule isn’t necessarily restrictive, but it does require thoughtful planning and coordination with your realtor and 1031 Exchange specialist to keep everything on track.

At some point, however, you may want to exit active real estate investing entirely—maybe you’re ready to sell rental properties without buying something new. There are tools and strategies that allow you to do this while still deferring or minimizing capital gains taxes. This is where our team, alongside your legal and tax advisors, can help you evaluate your options and build a smart, tax-efficient exit plan.

For multi-owner LLCs, exits can get complicated when partners want to go their separate ways. Your Operating Agreement should spell out buyout terms, transfer rights, and dispute resolution procedures. Without clear guidelines, dissolving or splitting the LLC can become messy, delay the sale, or even force unwanted outcomes. Planning ahead is essential—and working with professionals can help protect everyone’s interests.

Structure | Strengths | Considerations |

LLC | Liability protection, clean business identity | Setup/admin costs, finances must stay separate |

Trust (Revocable) | Probate avoidance, ease of transfer | Weak liability protection, less rigidity |

Trust (Irrevocable) | Estate defense, credible protection | Complex setup, access limits |

LLC inside Trust | Layered protection + estate planning | Slightly more complex to establish |

Your real estate investments don’t have to feel like an unplanned mountain trek full of risks and surprises. With careful planning, clear milestones, and solid liability coverage, you can build a structure that protects your investments and supports your family’s future.

Whether you want to go the LLC route, create a trust, or combine them into a robust fortress of protection, connect with a Colorado-based real estate attorney or CPA. They know the local landscape of STR laws, taxes, and title nuances—and can help you craft the perfect structure for your portfolio and peace of mind.

📞 970-389-6987

Disclaimer: All information contained in this web site is deemed reliable but not guaranteed. All properties are subject to prior sale, change or withdrawal notice. COMtnRealty.com believes all information to be correct but assumes no legal responsibility for accuracy.